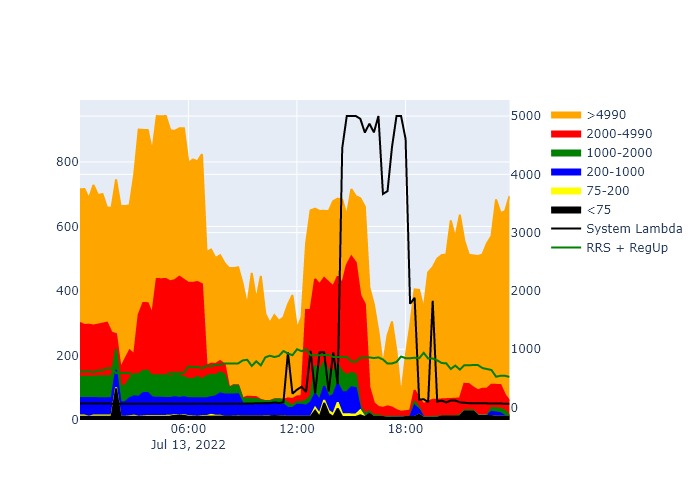

July 13th was the tightest day in 2022. And batteries are fast become a real game changer in ERCOT; so how did they operate when the rubber hit the road?

Well, let’s see, shall we. Filled sections of the chart are the energy offered to the real time market color coded by price range. The lines are self-explanatory (hopefully).

Of course we see that (as usual) much/most of the energy is offered at the cap ($5000/MWh). This is normal behavior from batteries. However, the two things that interested me as I looked at this chart were the sharp drops in SCED available capacity at 7:00 and 16:00. With a little inspection the 16:00 drop is not that surprising, as it comes an hour after the price spike and almost all batteries in ERCOT at that time were one hour batteries (they still are). As the batteries run out of charge their high limit drops. The reason for the drop at 7:00 was not clear originally, but l looked at the 60 day in our database and saw that 4 batteries with a combined HASL of ~260MWs of HASL had switched to ONTEST from 7:00-12:15. It was a little surprising to see ONTEST used on the tightest day of the year, but the four resources were relatively new at the time and were probably still being qualified for services; they came back before the prices got too high, so no real problem.

Register Here During GCPA : Register

Take the Guesswork Out of ERCOT

Know where you’re going. Know where you need to be.

Data and Software

Meet the Experts

Steve Reedy

Chief Executive Officer

Greg Graham

Chief Technical Officer

© 2025 Copyright CIM View. All rights reserved.

© 2025 Copyright CIM View.

All rights reserved.

All rights reserved.